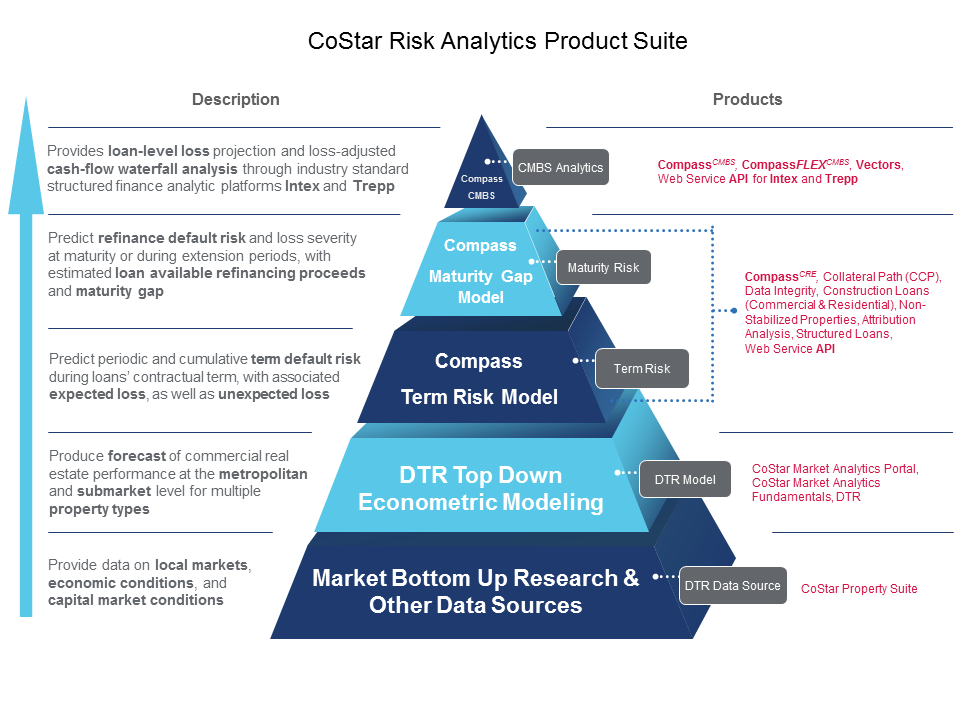

CoStar Risk Analytics works with market participants across the commercial real estate (CRE) lending spectrum. We provide a set of tools that allow the different constituents to enhance their capabilities regarding evaluation of markets, properties, and loans. Key tools include the underlying granular data, assessment of current market fundamentals, forecasts of future market performance, and credit default models. Collectively, CoStar Risk Analytics’ tools, in conjunction with CoStar granular data, provide lenders with the ability to better target business, appropriately price loans, make informed approval of credits, actively manage their portfolio with robust stress testing and surveillance measures, assess refinance risk, and execute within a disciplined framework. These tools ensure a consistent application of a market view throughout the life cycle of a loan. Provided below are brief descriptions of these key tools.

Portal Delivery/Point Data: The Portal is a delivery platform for research, analytics, and granular data surrounding a specific address and property type. Information is organized around clearly defined tabs, for ease of access.

Fundamentals with Submarkets: Fundamentals are reports which include forecasts of vacancy rates, demand, supply, and rent changes for 210 markets (over 3,700 unique submarkets) and five core property types: apartment, office, retail, warehouse, and hotel.

Property Performance Forecasts (DTR Model): The Derived Transaction Returns (DTR) model is our forecasting model. It is a system of simultaneous econometric regressions, the ultimate outputs of which are forecasts of CRE fundamentals and performance in the 210 markets (including over 3,700 submarkets) that CoStar covers. DTR forecasts fundamental drivers of return (vacancy, rents, etc.) that produce net operating income and property value. As the name indicates, the DTR model ultimately provides forecasted performance: the total return on income-producing properties – reflecting the hybrid nature of real estate investments, which have a bond-like yield return (investment yield) and an equity-like investment return (capital value return).

CoStar Risk Analytics CompassCRE Mortgage Credit Model: CompassCRE is CoStar Risk Analytics’ premier CRE risk management tool. Available as a desktop application and web service API, it allows users to calculate Probability of Default (PD), Loss Given Default (LGD), Expected Loss (EL), and Confidence Interval (of Expected Loss) results for a loan or a portfolio. It provides direct comparisons of credit risk and refinance risk across Time, Market, Property Type, and Loan Structure for all macroeconomic forecast scenarios.

CoStar Risk Analytics CompassFLEXCMBS (“FLEX”) on Trepp and INTEX is CoStar Risk Analytics’ fully integrated credit modeling solution within Trepp Analytics and INTEXcalc. It enables users to run customized CMBS loan default and loss forecasts via a set of user controls over CoStar Risk Analytics’ CompassCRE Desktop credit model along with Trepp and INTEX advanced features, including delays, recoveries, and ASERs, that tie directly to Compass default and loss results.

CoStar Risk Analytics CompassCMBS on Trepp allows users to view and utilize in CMBS analytics loan-level time series of PD, LGD, and EL for CMBS deals across three forecast scenarios, plus an additional stress scenario. Results are available for term risk alone as well as for the combination of term and maturity risk for each economic scenario. The scenarios are seamlessly integrated into Trepp and are available in both Trepp Watch and Analytics screens, selectable from dropdown menus.

Vectors on Trepp Analytics and INTEXcalc (NOI and Value) are selectable as the “Credit Based” collateral performance model option, which allows users to set their own threshold triggers for defaults, losses, recoveries etc. in Trepp Analytics.

Partner Portal provides Trepp (coming soon to INTEX) clients with limited access to the Portal. Through the Partner Portal, investors can access data and forecasts of vacancy rates, demand, supply, and rent changes for 210 markets (over 3,791 unique submarkets) and five property types: apartment/single-family, office, retail, warehouse, and hotel, in addition to the Market-Time summaries.