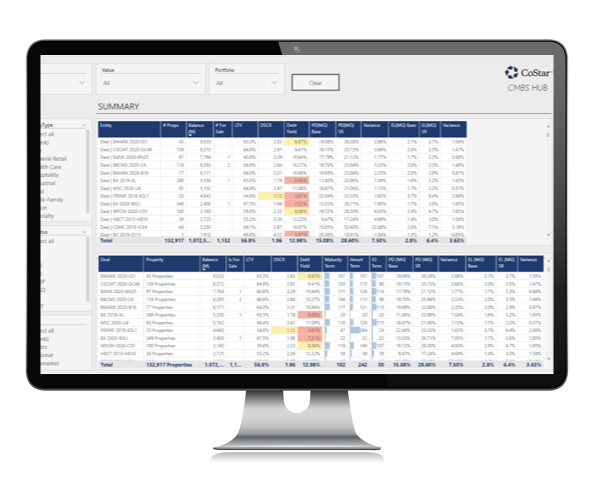

CMBS AdvantageTM Platform

CMBS AdvantageTM Dashboard

See How CoStar’s CMBS AdvantageTM Platform Can Keep You Ahead of the Competition

The CMBS Advantage platform offers CMBS investors a significant competitive edge. The platform integrates INTEX's CMBS data with CoStar's best-in-class CRE data, research and market analytics, along with the Compass mature credit default model and over 500 fields mapped directly to each CMBS deal, loan, and piece of collateral property.

The Most Comprehensive CMBS Analytics Platform

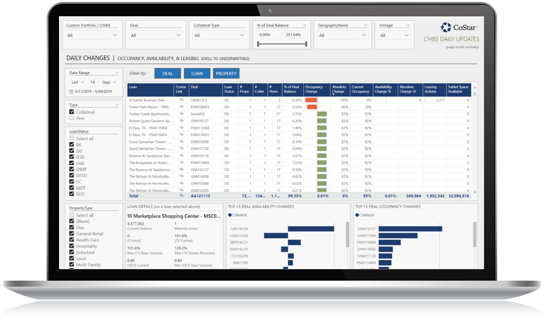

Monitor Your CMBS Collateral in Real Time

- Your custom CMBS deal portfolio is monitored across the entire CoStar ecosystem in real time, delivering all changes to your desktop daily. Know and react to changes that impact your securities performance immediately

- All loan and property related fields are tracked and updated daily

- New deals are added within two business days

- Actionable daily alerts allow you to access over 500 fields of property and loan-level insights with the push of a button

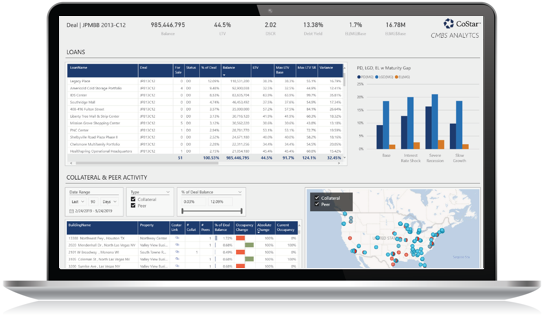

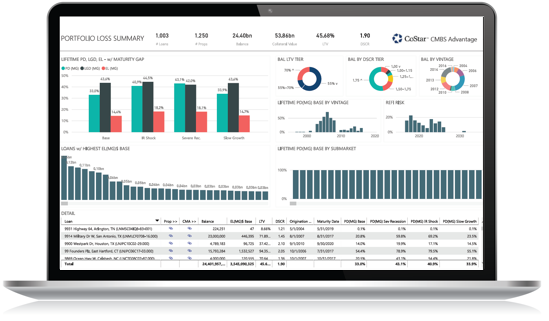

Analyze Your CMBS Securities Like Never Before

- Quickly identify out-of-date service provider data including tenants, occupancies and rent by comparing with accurate, updated CoStar data

- Access daily updates of property occupancy, space availability, subleases, leasing activity, construction and much more

- Get a detailed view of the competitive landscape in areas including peers, sale comps, construction, demographics and submarket analytics

- View updated NOI and values based on historical submarket and property type performance

- Customize NOI/NCF and value overrides for the INTEX credit model

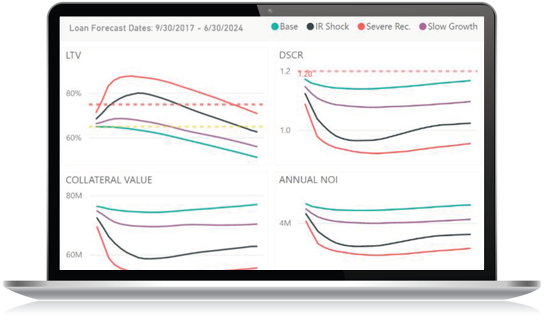

Compass Vectors on INTEX and Trepp

- NOI and Value are selectable as CMBS Credit Model collateral performance options, allowing you to set your own threshold triggers for defaults in INTEX and Trepp

- NOI Vectors offer NOI forecasts for base case, severe recession and up to four alternate scenarios

- Appraised value vectors offer appraised value forecasts for base case, severe recession and up to four alternative scenarios

CoStar's CompassFLEXCMBS on INTEX and Trepp

- CompassFLEXCMBS provides users with a customizable credit analytics tool used widely across the industry for over a decade and shown to be highly predictive of CRE loan performance

- Is extensively back-tested and validated by an independent third party

- Outputs monthly Constant Default Rate (CDR) and Loss Severities (SEV) at the loan level

- Offers multiple economic scenarios and custom stress testing

- Allows users to customize delays, recoveries, and ASER calculations

- Is fully integrated with INTEX and Trepp and is available as an API